Where do you buy your clothes from? Do you directly go and buy cotton from a wholesaler? Then do you buy yarn and make cloth out of it? Or do you go to a mall with hundreds of shopping outlets to buy your dress from? Well, your answer should be the second one. When you are buying all the commodities one by one, then it costs way more as well as, takes a lot of time to be completed. On the other hand, when you buy a readymade product, you don’t need to go through all the hassle, makeover, you also get the advantage to choose from hundreds of options that you will find in the malls.

Now, similarly, as an in-store when you first begin your journey in this platform, you will be looking for new options and you will be willing to know more about the processes of joining this platform and all. Now, despite your understanding of the Forex market from different articles and other media, you will have to get some first-hand knowledge of the market. Andthis is usually provided by the brokers. They are responsible to inform the investors how to make an account and find their trading styles. That’s why it is very important to find the right broker for you.

Now selecting the right broker in Singapore is never an easy task. Rather, it is one of the toughest and most complex works of the investors. As the novice ones don’t have much idea of this market, they might find it pretty difficult to select one at the beginning. While you are trying to find a broker, you should keep some conditions in mind.

- The broker should be reliable

- Has reputation for the service it provides to its clients

- Matches well with your trading style

- Provides all the facilities you require for your trading career

- Has a reasonable fee and commissions

- All their terms and conditions are agreeable

If any one of these conditions are not met while you are on a broker hunt, you might have to think twice before saying yes to that broker, because, there are plenty of other brokers on this platform. Just because you didn’t agree with one doesn’t mean you will not find the best broker for you. You need to understand that you might not be able to choose the right broker at the beginning. Always remember, you need a broker like Saxo so that you can take best quality trades. To get more info about them, you can visit their official website.

With time, you will gradually understand what to look for in a broker before agreeing to work with them. You should also keep in mind that if one broker doesn’t fit your choice, it doesn’t mean that the broker is unreliable. There could be several reasons for saying no to a broker. Maybe the broker you said no to was a pretty reputable one but it wasn’t the perfect one for you. Here’s why you should stick to a reliable and perfect broker.

Transparency

As a smart trader, must demand to see the transcripts of monetary transactions of several companies and organizations to understand where to put your cash in. And for that reason, transparency is highly required and only a reliable regulated broker can ensure that.

Trading facilities

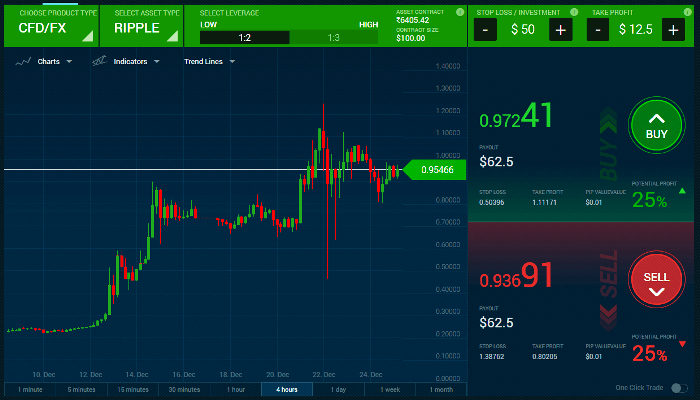

The facilities provided by the regulated broker play an important role in the trade of investors. If your investor doesn’t provide you with an advanced trading platform then it might not be possible for you to monitor many charts. That’s why you should choose a broker that provides the best facilities.

Fees and commissions

The fees and commissions of the brokers play an important role in the money management of the investors. As an investor, you should choose a broker whose fees and commissions are compatible with your capacity.

Proper trading regulation and under your trading style can be a huge help to choose the correct and most reliable regulated broker in this industry.