Paytm is one of the most popular payment services in India. Every day, millions of transactions happen on Paytm by the user of this payment wallet provider. Even merchants and shops accept payments from their customers with Paytm. However, in order to use the Paytm account without any limits, users must complete their KYC verification. Earlier, you could only complete this process from an official KYC agent. However, Paytm has enabled video KYC processes nowadays. So, you can do Paytm KYC online as well. You can complete the full KYC process online, and use Paytm without any limits to send, receive payments, and do other things on this platform.

However, when a user wants to verify their Paytm KYC online, they face issues. Because they don’t get proper guidance to complete their KYC. But don’t worry. Because, below, we have described the complete process to complete your KYC easily. So, you can just follow the below process and complete KYC without any issues. You can do that from the Paytm app itself. So, you don’t need to call any agent or do other things to complete your KYC.

Note: Nowadays, people are scamming Paytm users by the name of doing KYC. If you receive any call from anyone, claiming to be a Paytm employee, and wanting to complete KYC, you should ignore it. Don’t share your account details or do not download any app if someone asks you to.

Below, we have described the official way to complete Paytm KYC. So, it’s a safe method to do the same. You can just follow the below process to do that easily without any issues.

About Paytm

Paytm is one of the largest payment systems in India. They provide wallet to wallet, and bank to bank payment services using UPI technology. Other than sending and receiving money, you can do other things as well with Paytm. There are utility services like recharge, bill payment, train ticker, flight ticket, etc options are available in the Paytm app. You can install the Paytm app on your Android or iOS device, create an account and then start sending money to another Paytm user, or to a UPI ID.

Paytm also has launched its e-commerce service and Paytm payments bank, an RBI-approved digital virtual bank. Other than India, Paytm is also available in some other countries. It also has QR based payment system, where a user can scan the QR code, and send or receive money to their Paytm wallet, or directly to their bank account.

What is Paytm KYC?

KYC stands for Know Your Customer. It is a verification process done by payment service providers and banks to verify the account of the owner. The payment provider or bank asks the customer to provide supporting documents to complete KYC verification. This process makes sure that the account is of the owner.

Similarly, you have to complete Paytm KYC when you want to unlock some payment options in the Paytm app. When you complete your Paytm KYC, you won’t get any limits when sending or receiving the payments. You can also open a Paytm Payments Bank account while you complete the Paytm KYC.

What are the Benefits of Completing Paytm KYC?

It is recommended to complete your Paytm KYC if you are a Paytm user. Below, we have described the benefits of completing your Paytm KYC. So, if you want to enjoy these features in your Paytm account, you have to complete the KYC to do so. So, just read the following features that you can enjoy after completing your Paytm KYC. Below, we have described the features you’ll get when you complete your Paytm KYC in online and offline mode.

Send/Receive Money without Limits

When you complete your Paytm KYC, you can send or receive money with your Paytm account without any limits. Completing the KYC will also make sure that you send or receive payments from other Paytm users. So, if you want to use Paytm to send or receive money without limits, you have to complete the KYC verification process.

Transfer Money to Bank

Paytm also works as a wallet service. In your Paytm wallet, you can add money if you want, use it to bill payments, and use other utility services. However, without completing the KYC verification, you can’t transfer money from your Paytm wallet to your bank account. So, if you have a balance in your Paytm wallet account, and want to transfer the balance to your bank account, you have to complete Paytm KYC verification.

Maintain Balance Upto 1 Lakh

If you are a non-KYC Paytm user, you might see limitations in maintaining a high balance in your Paytm account. However, completing the KYC verification will allow you to maintain a wallet balance of up to 1lakh INR in your Paytm account. So, it’ll be a full-fledged Paytm account without any balance limitations.

Open Paytm Payments Bank Account

When you complete your KYC, you get the option to open Paytm Payments Bank account if you want. However, this feature is optional. So, you can choose if you want to open a Payment Bank account or not.

How to Complete Paytm KYC?

There are various ways to complete your Paytm KYC verification including the online method. So, you can choose your preferred way to complete the KYC process. Below, we have described different methods to complete the Paytm KYC process. so, you can choose your preferred method, and complete the KYC without any issues.

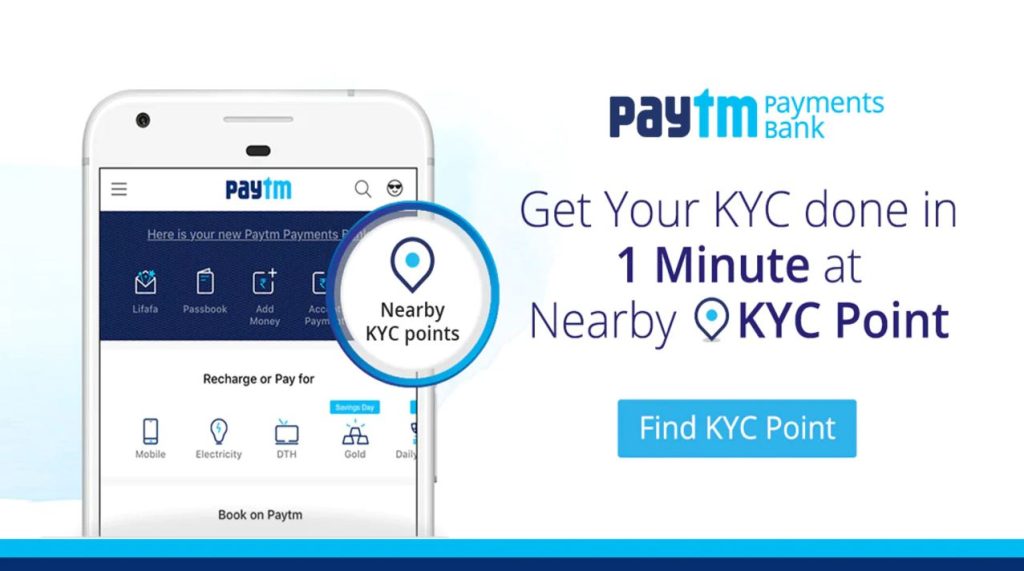

KYC Point Based

Paytm has its KYC points in different shops in India. So, if you want to complete your Paytm KYC, you can just go to your nearby Paytm KYC points, and complete your KYC easily without any issues. To complete the KYC through KYC point, you should have the following documents to carry with you.

- Aadhar card

- PAN Card

- The mobile number which is linked with your Aadhar card

After visiting the nearby KYC point, just ask the KYC partner to complete your KYC. You have to provide your fingerprint as well to complete the KYC verification. You also may want to open Paytm Payments Bank account from the KYC point if you want. If you don’t need to open the account, just ask the KYC partner to remove it.

Note that doing Paytm KYC from the KYC point is completely free. So, you don’t have to pay the KYC partner any money to complete your KYC.

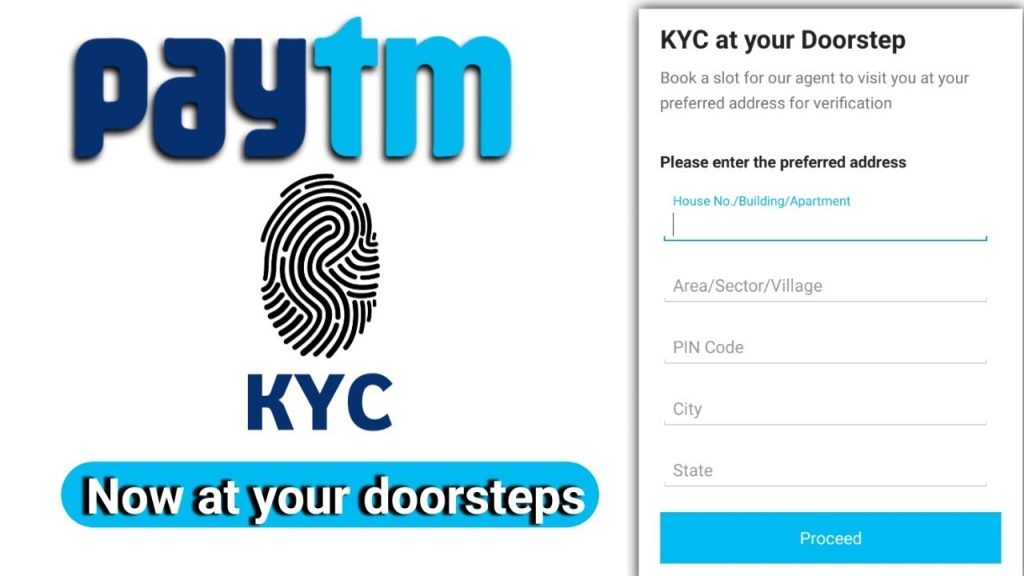

Doorstep KYC Verification

Paytm has recently started this service for its users. You can request doorstep KYC verification and a Paytm agent will come to your doorstep to collect the necessary documents to complete the KYC. You have to pay a service fee to complete the Paytm KYC in this method.

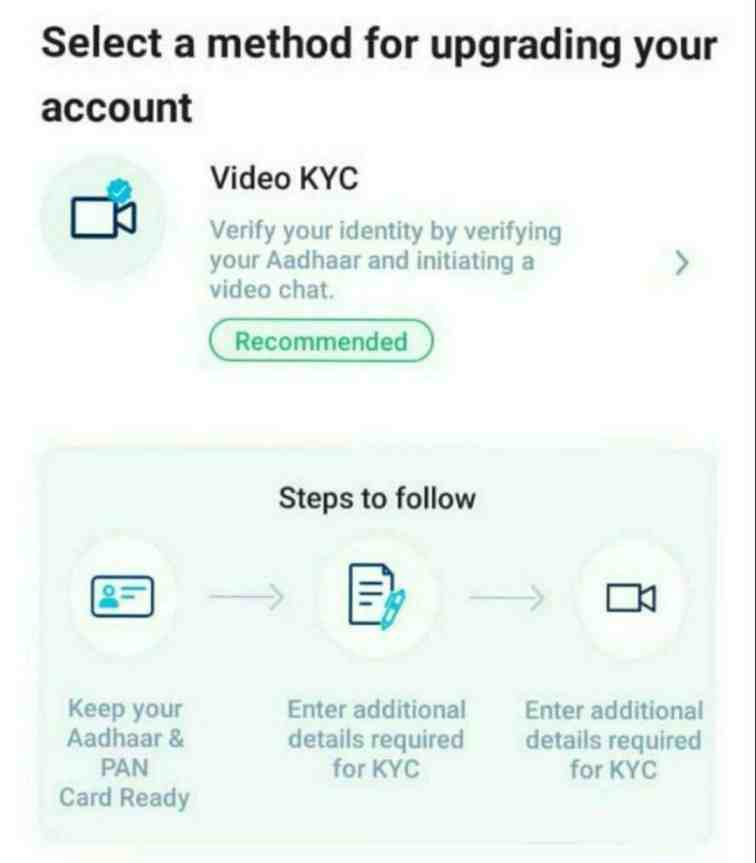

Paytm Online KYC

This is the most hassle-free method to complete your Paytm KYC verification. You can complete your KYC online as well. And you get the option in the Paytm official app. So, in this method, you can complete your Paytm KYC with video verification mode without visiting anywhere. All you need to do is to show your Aadhar and PAN card to the video KYC agent, and they’ll complete the KYC verification. Below, we have described how you can do that easily with the official Paytm app. So, just follow the below process to complete your Paytm Video KYC online.

How to Verify Paytm KYC in Online Mode?

Before you proceed to do your Paytm KYC online mode, make sure to have the following documents with you to complete the process. As the verification process will be through video calls, you should also have your smartphone with a good camera.

Documents needed to complete Paytm Video KYC:

- Aadhar Card

- Pan Card

Now, follow the steps below to complete Paytm Online KYC.

- First of all, open the Paytm app on your smartphone.

- Now, click on your profile picture from the upper left corner of Paytm.

- Scroll down, and select the ‘Profile Settings’ option from there.

- Then, click on the ‘Profile’ option.

- There, you’ll see if your Paytm account is KYC verified or not. If not, click on the ‘Upgrade’ option to complete your Paytm KYC.

- You’ll see the video KYC option there. Click on it to proceed to complete your Paytm video KYC in online mode.

- It’ll ask for your Aadhar number and your name on the next page. Enter the details and proceed.

- Next, you have to verify your Aadhar card with OTP. OTP will be sent to your mobile number that is linked to your Aadhar card. Verify the OTP, and then proceed.

- Then, you have to provide some more details like profession, father’s name, etc. Complete the profile and proceed.

- Now, enter your PAN card number and click on the ‘Proceed to video call’ option.

- Then, select ‘Start my video verification’ to start the video KYC verification.

- After that, it’ll start the video KYC process. You’ll find the Paytm official KYC agent in the video call. He’ll ask you to show your related documents and capture your photo.

- That’s it. After following the process, it’ll successfully complete your video KYC. Now, you can start using Paytm without any limitations.

Frequently Asked Questions (F.A.Q)

Is it safe to complete Paytm KYC in online mode?

Yes. It’s safe to complete the video KYC of Paytm in online mode. You can do that from the official Paytm app itself. So, there’s no need to worry if you are using the Paytm official app to complete your video KYC.

Someone is Calling Me and Asking for OTP to complete Paytm KYC, what to do?

You should not share any details with any person claiming to be a Paytm employee. Paytm NEVER CALLS YOU to collect your OTP or any other personal details. If you get such calls, it might be a fraud, and fraudsters can scam you by collecting the OTP and transferring money from your bank account.

Is Aadhar Card mandatory to complete Paytm KYC?

No, you can also use other documents like your Driving License, Passport, Voter Card, etc to complete your Paytm KYC. So, an Aadhar card is not mandatory to complete this process.

Is completing Paytm KYC mandatory?

You should complete the Paytm KYC verification as it removes the limitations from your Paytm account. You can use your Paytm account to send or receive money without any limits when you complete the KYC verification.

Can I complete Paytm KYC at home?

There are two ways to complete the KYC at your home. You can either request for doorstep KYC verification, which is paid, or you can complete Paytm KYC online at your home.

Is Paytm KYC free?

Yes. It’s free to complete your Paytm KYC. However, if you choose the doorstep verification method to complete the KYC, you have to pay a service charge. Other than that, the KYC point method and online method are completely free. So, you don’t have to spend any money to complete your KYC with these methods.

Can I complete Paytm KYC in Offline Mode?

Yes. You can complete your Paytm KYC on offline mode as well. There are various Paytm KYC points across India where you can go and verify your Paytm KYC easily without any issues.

How to get Paytm Payments bank account?

When you complete your Paytm KYC verification, you’ll get the option to enable Paytm Payments bank. So, you can choose it from there. It’s an optional option. So, when you visit a KYC point, you can ask the KYC agent to enable it for you.

Read Also: Recover Deleted Photos in Messenger

Final Words

So, guys, I hope you have found this guide helpful. If you liked this guide, you can share it on social media platforms with your friends. Just use the share buttons below to share this guide. Above, we have described the complete process to complete your Paytm KYC. So, you can just follow the process to do the same. If you have any questions or queries, you can just ask them in the comment section below. You can also provide your feedback in the comment section below.