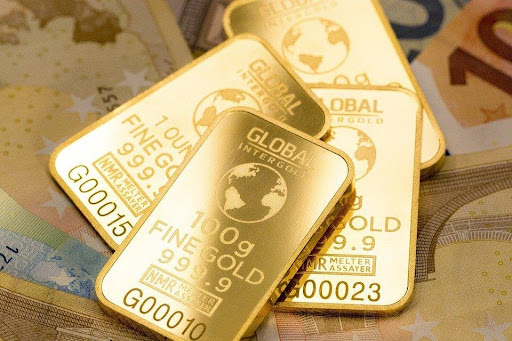

Gold is not only used as jewelry, but it’s also a popular investment vehicle in today’s times. This is one of the best options to diversify your portfolio because it’s a store of value. This means that your portfolio will fare well with economic volatility, sudden stock market downturns, and recessions when you have a small portion invested into precious metals.

However, as with any other investments in the market, it’s essential to do your research beforehand. Choose legitimate companies that offer genuine products and services that will ensure that the gold bullion, coins, and jewelry that you’ve ordered will actually be shipped to you. You can find out the legitimate ones through this review, other websites, communities, and social media platforms where the comments of previous clients are visible. With this said, here are other things that you should take into consideration before investing in precious metals.

- Know the Cost per Gram

Experienced investors know that they need to buy low and sell high. Many trustworthy websites can provide you with price comparisons and charts about the past performance of the metals in the market. Find out the current spot price of gold or the costs per gram and see if now is the right time to add the bullion and bars into your investments through these sites.

Spot prices may be different from one showroom to another. This is because the sources may vary, and there are usually a lot of associations and providers involved in a website that will affect the production, circulation, and current supply of the gold bullion. It’s worth noting that the more popular websites will offer similar spot prices and rates, so it’s best to go with the most affordable ones. Check out the meaning of spot price on this site here.

- Check the Levels of Purity

Gold is available in different sizes and purity, and these factors will primarily affect the price. The other metal and the gold will usually determine the price. For example, a 24K or 100% gold is the purest form in the market, which is malleable. However, some companies will add another metal to strengthen the ornamental bracelets and necklaces in some jewelry, and they will become an alloy. TheBracelets would be a great consideration if you are looking for a vast collection of bracelets.

A 22K jewelry will have two parts of another metal and 22 parts or 91.6% gold. In 18K, the six parts will be made up of another metal, and the total percentage will be around 75%. It’s best to research the purity levels that you’re looking for, and it’s worth noting that the IRS will require you to get the metals with at least 99.95% purity before adding this into your retirement account.

- You need to Keep the Bullion in a Depository

When you’re thinking of investing in bullion or coins, you need to consider where you will store the physical asset once it’s in your hands. A depository from your local bank may be a good choice since storing them in your home may result in theft and burglary. If you prefer to keep the gold bars inside your home, buying a reliable and strong safe is highly recommended.

If you don’t have a safe place to store, you may try with the local credit union in your area to see if they offer storage services. Other facilities are designed to store massive amounts of bullion, and gold companies often have access to them. If you decide to keep the coins in another third-party depository, you may want to be prepared with the storage fees, which can reduce your gains.

- Gold Certificates Can Become a Scam

Gold certificates or the ones written on paper may make the whole process of investing in precious metals to be more straightforward. However, it’s crucial to invest with legitimate and trustworthy companies in the market because you don’t hold or see precious metals. When you think about this, the evidence you’ll have is the paper you have received. More about the certificates in this url: https://www.thesprucecrafts.com/what-is-a-gold-certificate-5186772.

When there’s economic turbulence, many scammers work tirelessly to produce these certificates. They trick people into buying the paper, especially the new investors. When you decide to choose the certificates, make sure to verify the broker or the name that you see on paper. Another issue with the certificates is that a company may sell them multiple times to different people. You wouldn’t receive a dollar when you decide to “cash in” during emergencies.

- Coins and Bullion are Different

Investing in physical assets, including gold bullion and coins, can be tricky. Understand that their rarity matters when you go with the coins and may add to the price. Another thing to consider with the coins is their fineness and metal content.

It’s best to get a certified third-party provider to verify whether the coins are genuine or not. Some have value based on how rare they are, and they can be similar to collector’s items, and you might not be able to add them into your retirement account. Acceptable coins may include the American Eagle, Canadian Maple Leaf, and more. The list of unacceptable products for investments may consist of Italian Lira, Swiss Franc, Dutch Guilder, and South African Krugerrand, but they are usually considered collectibles.

How Much Should You Invest in Gold or in a Gold Investment?

Know that the value of precious metals can be volatile in a Gold Investment, and you might want to do a lot of research before taking the plunge. It’s highly advised to invest only 10% of your portfolio in hedging against sudden market downturns and inflation. Once you have built a solid position, you may want to do periodical checks on your portfolio so your relative exposure to the precious metals will stay the same.

It’s best only to buy small amounts of precious yellow metals while a Gold Investment, especially when the prices are low. When the spot price is high, you can expect that the stocks, certificates, and ETFs will go up as well. It might mean a more lackluster return for you, but it wouldn’t diminish the overall returns of holding something that will diversify your portfolio.